Things about G. Halsey Wickser, Loan Agent

Table of ContentsThe smart Trick of G. Halsey Wickser, Loan Agent That Nobody is Talking AboutAbout G. Halsey Wickser, Loan AgentG. Halsey Wickser, Loan Agent for BeginnersAbout G. Halsey Wickser, Loan Agent9 Easy Facts About G. Halsey Wickser, Loan Agent Shown

The Assistance from a home loan broker doesn't finish when your home loan is protected. They provide ongoing assistance, aiding you with any kind of concerns or problems that arise throughout the life of your funding - mortgage lenders in california. This follow-up assistance ensures that you continue to be pleased with your mortgage and can make enlightened decisions if your economic circumstance modificationsSince they collaborate with numerous lending institutions, brokers can find a lending product that suits your special financial situation, even if you have been turned down by a bank. This versatility can be the trick to unlocking your imagine homeownership. Selecting to collaborate with a mortgage consultant can change your home-buying trip, making it smoother, faster, and a lot more monetarily helpful.

Finding the best home on your own and figuring out your budget plan can be very demanding, time, and money-consuming - california mortgage brokers. It asks a whole lot from you, diminishing your energy as this task can be a job. (https://gravatar.com/halseyloanagt) A person who acts as an intermediary in between a customer an individual seeking a home loan or home funding and a lender typically a financial institution or cooperative credit union

7 Easy Facts About G. Halsey Wickser, Loan Agent Described

Their high degree of experience to the table, which can be critical in helping you make informed choices and eventually accomplish successful home financing. With rates of interest rising and fall and the ever-evolving market, having a person completely tuned in to its ongoings would certainly make your mortgage-seeking process a lot easier, soothing you from navigating the battles of completing paperwork and doing heaps of research.

This allows them provide experienced support on the finest time to safeguard a home loan. Due to their experience, they likewise have established connections with a vast network of loan providers, ranging from significant financial institutions to specific home mortgage service providers. This considerable network enables them to provide buyers with different home mortgage choices. They can utilize their connections to locate the most effective lenders for their customers.

With their industry understanding and capability to bargain efficiently, home loan brokers play a pivotal role in securing the very best mortgage deals for their clients. By keeping relationships with a varied network of lending institutions, home mortgage brokers get to numerous home loan choices. Their enhanced experience, explained above, can provide invaluable information.

Excitement About G. Halsey Wickser, Loan Agent

They have the skills and techniques to encourage lenders to provide far better terms. This might include reduced rates of interest, lowered closing expenses, or perhaps extra versatile repayment timetables (G. Halsey Wickser, Loan Agent). A well-prepared home mortgage broker can provide your application and economic profile in a manner that attract lenders, boosting your chances of an effective negotiation

This benefit is commonly a pleasurable shock for numerous buyers, as it allows them to take advantage of the experience and resources of a home loan broker without fretting about sustaining extra costs. When a borrower protects a home mortgage through a broker, the loan provider compensates the broker with a compensation. This payment is a portion of the financing quantity and is typically based on elements such as the rate of interest and the kind of finance.

Home loan brokers succeed in recognizing these distinctions and functioning with lenders to locate a home mortgage that suits each borrower's specific needs. This personalized strategy can make all the distinction in your home-buying journey. By working carefully with you, your home loan broker can guarantee that your funding conditions line up with your financial objectives and abilities.

The Main Principles Of G. Halsey Wickser, Loan Agent

Customized home loan services are the trick to a successful and lasting homeownership experience, and home mortgage brokers are the professionals that can make it happen. Working with a mortgage broker to work alongside you might lead to quick lending approvals. By using their proficiency in this field, brokers can help you avoid possible challenges that frequently create delays in loan approval, causing a quicker and extra efficient path to protecting your home funding.

When it comes to purchasing a home, navigating the world of home loans can be frustrating. With numerous options available, it can be challenging to find the best finance for your demands. This is where a can be a valuable resource. Mortgage brokers serve as intermediaries in between you and prospective loan providers, assisting you discover the very best home mortgage offer customized to your certain scenario.

Brokers are fluent in the details of the home mortgage sector and can provide valuable insights that can help you make educated choices. As opposed to being limited to the mortgage items used by a single lender, home mortgage brokers have accessibility to a broad network of lenders. This means they can go shopping around on your behalf to locate the very best car loan options offered, potentially saving you money and time.

This accessibility to several loan providers gives you an affordable advantage when it concerns safeguarding a positive home mortgage. Searching for the best mortgage can be a taxing process. By collaborating with a mortgage broker, you can conserve time and initiative by letting them take care of the research study and paperwork entailed in searching for and protecting a funding.

Facts About G. Halsey Wickser, Loan Agent Revealed

Unlike a bank finance police officer who may be managing several customers, a mortgage broker can offer you with individualized solution customized to your specific needs. They can take the time to recognize your economic situation and goals, providing personalized options that straighten with your details needs. Mortgage brokers are competent mediators that can assist you safeguard the best feasible terms on your lending.

Neve Campbell Then & Now!

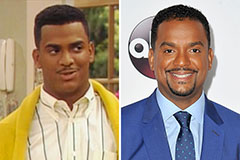

Neve Campbell Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Kane Then & Now!

Kane Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now!